The Definitive Guide to Real Estate Reno Nv

Get This Report about Real Estate Reno Nv

Table of Contents3 Simple Techniques For Real Estate Reno NvThe Best Guide To Real Estate Reno NvIndicators on Real Estate Reno Nv You Need To KnowSome Known Factual Statements About Real Estate Reno Nv

That may appear expensive in a world where ETFs and mutual funds might bill as low as zero percent for constructing a diversified portfolio of supplies or bonds. While systems may vet their investments, you'll have to do the exact same, and that suggests you'll need the skills to analyze the possibility.Caret Down Resources appreciation, reward or rate of interest repayments. Like all investments, actual estate has its advantages and disadvantages. Here are some of one of the most vital to keep in mind as you weigh whether to invest in property. Lasting admiration while you reside in the property Possible bush versus inflation Leveraged returns on your financial investment Passive revenue from rental fees or with REITs Tax benefits, including passion deductions, tax-free resources gains and depreciation write-offs Fixed lasting financing readily available Gratitude is not assured, particularly in financially depressed locations Residential property prices might drop with higher rates of interest A leveraged financial investment indicates your down settlement is at danger Might require significant time and money to handle your very own buildings Owe a set home loan settlement monthly, also if your lessee doesn't pay you Reduced liquidity genuine building, and high compensations While realty does supply numerous advantages, particularly tax obligation benefits, it doesn't come without significant disadvantages, particularly, high commissions to leave the market.

Do you have the sources to pay a home loan if a renter can't? Just how much do you depend on your day work to maintain the investment going? Readiness Do you have the wish to serve as a property manager? Are you ready to function with occupants and understand the rental regulations in your area? Or would certainly you like to analyze bargains or financial investments such as REITs or those on an on-line platform? Do you intend to meet the needs of running a house-flipping company? Expertise and skills While several investors can find out at work, do you have unique skills that make you better-suited to one sort of investment than another? Can you examine supplies and build an attractive profile? Can you repair your rental property or take care of a flipper and save a package on paying professionals? The tax obligation advantages on realty vary commonly, depending upon how you spend, however spending in property can use some substantial tax obligation benefits. Real Estate Reno NV.

What Does Real Estate Reno Nv Mean?

REITs use an attractive tax obligation account you will not sustain any kind of resources obtains tax obligations till you market shares, and you can hold shares essentially for years to stay clear additional reading of the tax obligation guy. In truth, you can pass the shares on to your beneficiaries and they won't owe any type of taxes on your gains.

Realty can be an attractive investment, however financiers wish to be certain to match their kind of financial investment with their willingness and ability to manage it, including time commitments. If you're wanting to produce earnings throughout retirement, genuine estate investing can be one method to do look at this now that.

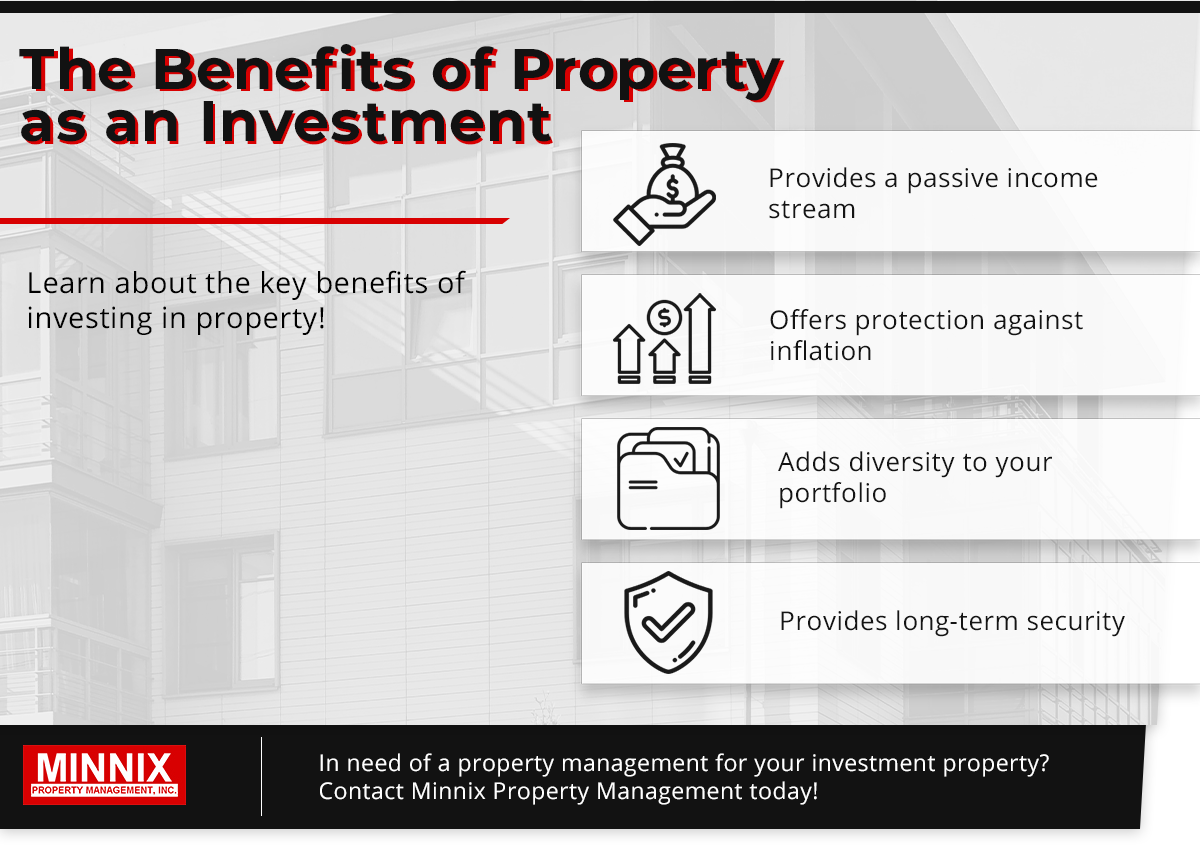

There are numerous advantages to buying property. Constant revenue flow, solid returns, tax advantages, diversity with well-chosen properties, and the capacity to take advantage of wealth via property are all advantages that capitalists might take pleasure in. Here, we look into the various benefits of purchasing realty in India.

The Ultimate Guide To Real Estate Reno Nv

Genuine estate has a tendency to appreciate in value over time, so if you make a wise financial investment, you can make money when it comes time to market. With time, rental fees likewise have a tendency to raise, which might boost capital. Leas increase when economic climates increase because there is more need for real estate, which increases funding worths.

If you are still functioning, you may maximise your rental revenue by spending it following your monetary purposes. There are various tax benefits to genuine estate investing.

5 lakh on the principle of a mortgage. In a comparable vein, section 24 permits a decrease in the necessary rate of interest repayment of approximately Rs 2 lakhs. It will significantly lower gross income while reducing the expense of realty investing. Tax deductions are attended to a range of expenses, such as business costs, money circulation from various other properties, and home mortgage passion.

Realty's web link to the other major possession groups is breakable, sometimes even adverse. Property may therefore lower volatility and increase return on risk when it is consisted of in a profile of various properties. Compared to various other possessions like the stock market, gold, cryptocurrencies, and financial institutions, buying actual estate can be considerably more secure.

Some Known Details About Real Estate Reno Nv

The supply market click for source is continually altering. The actual estate market has actually expanded over the past numerous years as a result of the application of RERA, lowered home finance interest prices, and other elements. Real Estate Reno NV. The rates of interest on bank interest-bearing accounts, on the other hand, are low, specifically when contrasted to the rising inflation